Select Language |

A merger or an acquisition means integrating two or more companies to create a more valuable end result. Each of the merged companies brings its own unique culture. Integrating the two cultures is one of the hardest parts of the process but also the most ignored and undermined. Over 80% of Mergers and Acquisitions fail to yield the intended results.

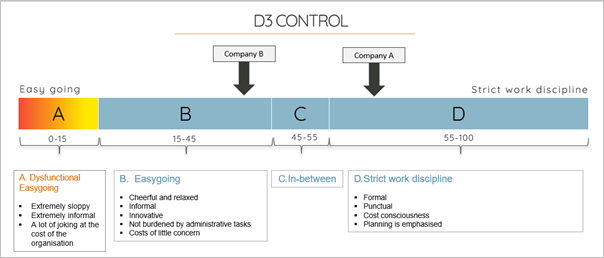

Let’s take an example of a big global bank, Company A, acquiring a successful small software company called Company B. The strategic intent behind this acquisition is to improve the in-house software design and innovation capabilities to help with digital transformation. Company culture assessments for both companies may show that Company A has a stricter work discipline, with a lot of emphasis on planning and cost consciousness. On the other hand, Company B has more agile ways of working where innovation is prioritised over following processes and cost consciousness.

Bringing the two teams together and expecting them to understand and accept each other’s way of working or culture will most likely lead to frustration and misunderstandings. Unfortunately, most companies end up taking this option. The integration team or leadership must be aware of the synergies or gaps between the two entities, so to set up the right integration process from the start. In this case, they could decide to keep the two companies as separate entities to allow Company B to retain its innovative and agile culture. Or they could look at the specific processes that can be adapted or merged to create a new entity with the best of both cultures.

Insights into the cultural synergies and gaps of the integrating companies can help the leadership and acquisitions team to set up necessary steps at an early stage in the process to avoid any company culture clashes and ensure smooth transition and integration.

Global Business Culture’s M&A cultural assessment program supports the integration team or leadership by measuring and analysing the culture and working practices across all the entities involved in M&As. This analysis and outcome help the team to objectively visualise the synergies and gaps between all entities and improves the outcomes of the intended merger or acquisition.

© Copyright 2024 Global Business Culture. All rights reserved | Legal Notices